Real Estate

We seize opportunities overlooked by traditional real estate managers

due to our ability to invest across the capital structure, across asset types and across geographies. Our deep network and proven ability to provide speed and certainty of execution consistently provide a competitive advantage in the commercial real estate market.

The Monarch Edge

Aptitude

Our dedicated professionals are talented and experienced, having invested approximately $15 billion in 145+ investments across the capital structure in various real estate segments for over 20 years.

Expertise

Our opportunistic approach and distressed heritage is a key differentiator in the real estate marketplace and gives us an advantage in finding attractive opportunities.

Partnership

While we focus on overlooked and niche areas driven by deep relationships with our operating partners, we are well-positioned to capitalize on dislocation across many segments of real estate: office, hospitality, healthcare, retail, and multiple other sectors.

Sectors

We focus on complex investment opportunities stemming from legal considerations, corporate issues, process inefficiencies, and / or dislocated market segments that have been overlooked by traditional players in the commercial real estate market.

Office

Hospitality

Healthcare

Retail

Opportunistic

Our focus on both debt and equity investments in public and private markets is designed to allow us to identify the most attractive risk-adjusted return opportunities across asset types and geographies.

Private Real Estate

Debt

- Secondary debt and direct lending opportunities leverage Monarch's credit expertise and deep sourcing relationships

- Debt backed by properties across a wide-range of industries

Equity

- Focus on high quality, institutional assets in dislocated markets or dislocated segments

- Portfolio and single asset acquisitions of over-looked or over-levered properties

- Utilize deep sourcing network and involvement in complex processes to acquire assets off-market

Public Instruments

Debt

- Expertise in leveraged loan, high yield, and structured credit markets

- Leverage extensive knowledge of debt capital markets

Equity

- Exploit shifting value differential between public and private markets

- Development of and investments across the REITs market

Differentiated Sourcing Capabilities

To generate a consistently robust opportunity set and actionable deal flow, we leverage a variety of differentiated sourcing channels developed over decades

Dislocated and Stressed Markets

Experience identifying and exploiting segments that have been beaten down

Redevelopments & Repositionings

Capitalize on assets undergoing fundamental shifts through capital investment and operating experience

Broken Processes

Navigate complex processes in a timely manner to uncover hidden situations

Corporate Overlays

Invest in debt and equity instruments of real estate companies irrespective of corporate structure

Institutionalizing Asset Types

Focus on niche property segments ahead of increasing institutional appetite

Transitioning Sponsorship

Provide speed and certainty of execution to counterparties, while minimizing disruption at the property

Recent Real Estate Press

Mar 31, 2025

Monarch Alternative Capital Continues Expansion of Real Estate Debt Platform through Multifamily Asset Financing Solution

Dec 18, 2024

The Westin Sacramento Riverfront Hotel & Spa Unveils New Name and Multimillion-Dollar Transformation

Dec 17, 2024

Executive Team Launches New Company – ‘Outrigger Industrial, LLC’

Apr 01, 2024

CRE Lending Solutions

Oct 05, 2023

801 Brickell

Jun 12, 2023

Go Outdoors

May 01, 2023

Hotel Felix & YOTEL San Francisco

Jul 13, 2022

Aloft, Holiday Inn Express & TownePlace Suites Orlando

Mar 15, 2022

Esplanade

Feb 24, 2022

Centris Industrial

Dec 16, 2021

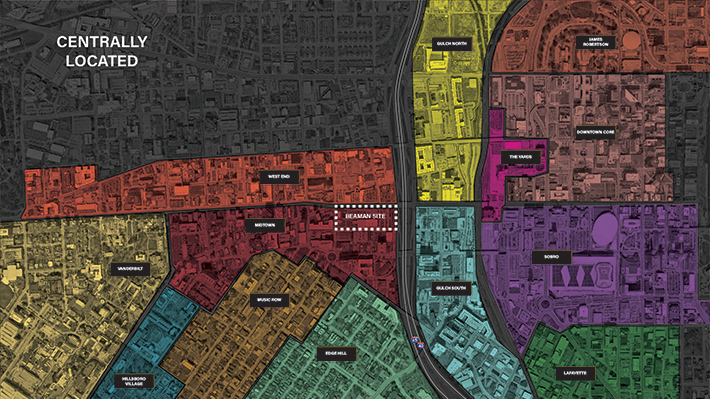

Nashville Development Site

Dec 01, 2021

SpringHill and TownePlace Suites Orlando

Oct 22, 2021

American House Portfolio

Oct 20, 2021

Westin Minneapolis

Oct 11, 2021

Quinn Residences

Sep 14, 2021

CA Health & Science Trust

Jul 29, 2021

One South

Jun 30, 2021

Apex at Legacy

Jun 28, 2021

Citigroup Center

Jun 25, 2021

Eagle Hospitality Portfolio

Apr 05, 2021

North Loop Portfolio

Mar 26, 2021